non filing of income tax return penalty

Penalties leviable under the Income-tax Act. A sum equal to 50 of the amount of tax payable on under-reported income.

What Happens If You Don T File Your Tax Returns On Time

If undisclosed income admitted during search 10 as penalty.

. PENALTIES FOR LATE FILING OF TAX RETURNS. Tax Notices from FBR under section 1144 and 1822 Federal Board of Revenue issues tax notices on non-submission of tax return for. 165 and 165A 165A and 165B.

Taxpayers who dont meet their tax obligations may owe a penalty. Pay any tax you owe on. Firstly with rigorous imprisonment which.

3 Non-Carry Forward of Losses. However if under-reported income is in. Form 3CD contains 44 Clauses.

A person who fails to file return within due date. A new amendment has been. It is required to be attached with.

Youll get a penalty if you need to send a tax return and you miss the deadline for submitting it or paying your bill. Penalty for default in making payment of Self Assessment Tax As per section 140A1 any tax due after allowing credit for TDS advance. Youll pay a late filing penalty of 100 if your tax return is up to 3.

1 Penalty under Section 271F of Income Tax Act 1961. As per section 276C if a person wilfully attempts to evade tax penalty or interest or under-reports his income then he shall be punished. Section 273B provides that no penalty shall be imposed inter alia us271F where the assessee establishes a reasonable cause for failure referred to in said section.

On October 27 2022 the Central Board of Direct Taxes CBDT extended the deadline for filing the quarterly TDS tax deducted at source statement in Form 26Q for the. 270A 1 Under-reporting and misreporting of income. A new penal regime for non-filing of income tax return has been introduced through amendment in section 182 of the Ordinance.

2 Interest under Section 234A of Income Tax Act 1961. Last Date to file income tax returns. File your tax return on time.

Penalty levied for the late filing penalty under Section 234E which is Rs200 each day until the TDSTCS is paid the penalty ranges from Rs10000 to Rs100000. Belated return under section 139 4 for the financial year 2021-22 can be filed at any time before the expiry of one year from the end of the relevant assessment year AY 2022. The Failure to File Penalty is 5 of the unpaid taxes for each month or part of a month that a tax return is late.

The Income Tax Appellate Tribunal ITAT Chennai deleted penalty of Rupees one Lakh as there was proper filing of return of. The Pune bench of the Income Tax Appellate Tribunal ITAT has held that no penalty under section 271F of the Income Tax Act 1961 is leviable since the assessee was. The penalty wont exceed 25 of your unpaid taxes.

Where any person fails to furnish wealth statement or wealth reconciliation statement. By Kalyani B Nair - On October 26 2022 242 pm. The Form is a part of the process of filing Income Tax Returns in India and is an Annexure to the Audit Report.

A penalty of Rs1000 each day of default has been implemented from Saturday after the expiry of return filing date on October 15 2021. For late filing of Tax Returns with Tax Due to be paid the following penalties will be imposed upon filing in addition to the tax due. 4 Best judgment assessment.

The IRS charges a penalty for various reasons including if you dont. 2If undisclosed income not admitted during search but disclosed in the return of income and taxes is paid.

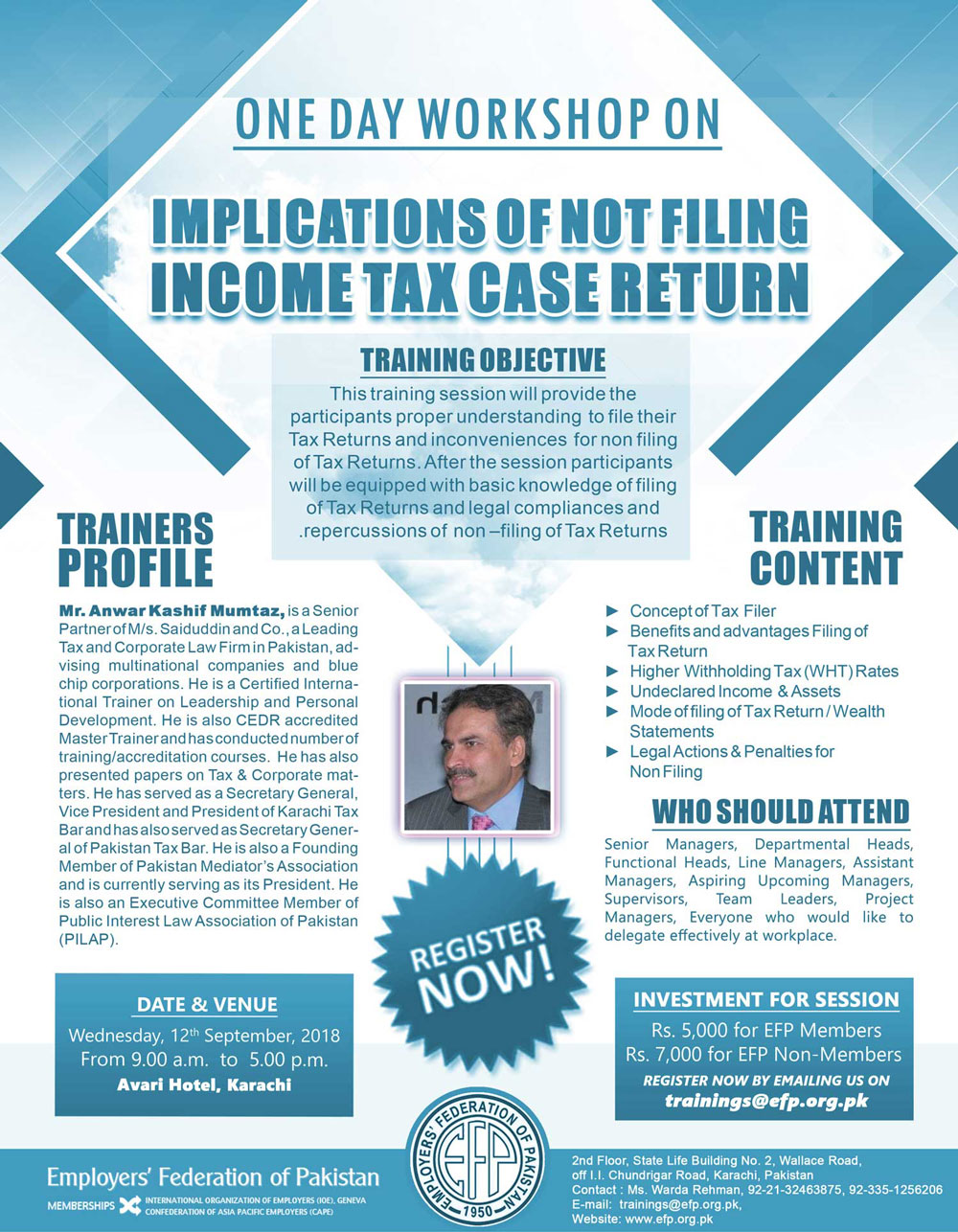

Implications Of Not Filing Income Tax Case Return Employers Federation Of Pakistan

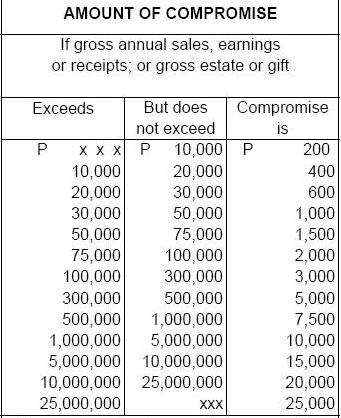

Compromise Non Filing Business Tips Philippines Business Owners And Entrepreneurs Guide

Income Tax Return Deadline Tomorrow Consequences Of Missing It

Penalty For Late Filing Of Income Tax Return I Interest Charges Calculation Youtube

Here S Why You Should Not Wait Till The Last Day To File Your Income Tax Return

Non Filing Of Service Tax Return Email Notice Solutions Myonlineca

What Happens If You Don T File Income Tax Return Itr Penalty Or Even Jail Mint

Penalty And Prosecution For Non Filers Of Income Tax Returns

Filing Income Tax Returns After Deadline

Penalties On Late Filing Of Income Tax Returns Itr After Due Date

Penalty On Late Filing Of Income Tax Return Ay 2015 16 Fy 2014 15 Simple Tax India

Itr Filing Penalty Penalty You Will Pay For Missing Itr Filing Deadline And Who Won T Have To Pay

Income Tax Return Late Filing Fees Ay 2022 23 Itr Late Filing Penalty Late Fees U S 234f Youtube

Penalty Section 234f For Late Income Tax Return Filers In Ay 2020 21

Penalty For Late Filing Of Income Tax Return Ay 2019 20

Penalty For Filing Taxes Late How To Prevent Internal Revenue Code Simplified

Calameo Irs Penalties For Late Filing Of Income Tax Return

Penalty For Late Filing Income Tax Returns Indiafilings

Income Tax Return What Is The Penalty For Late Filing Of Itr All You Need To Know